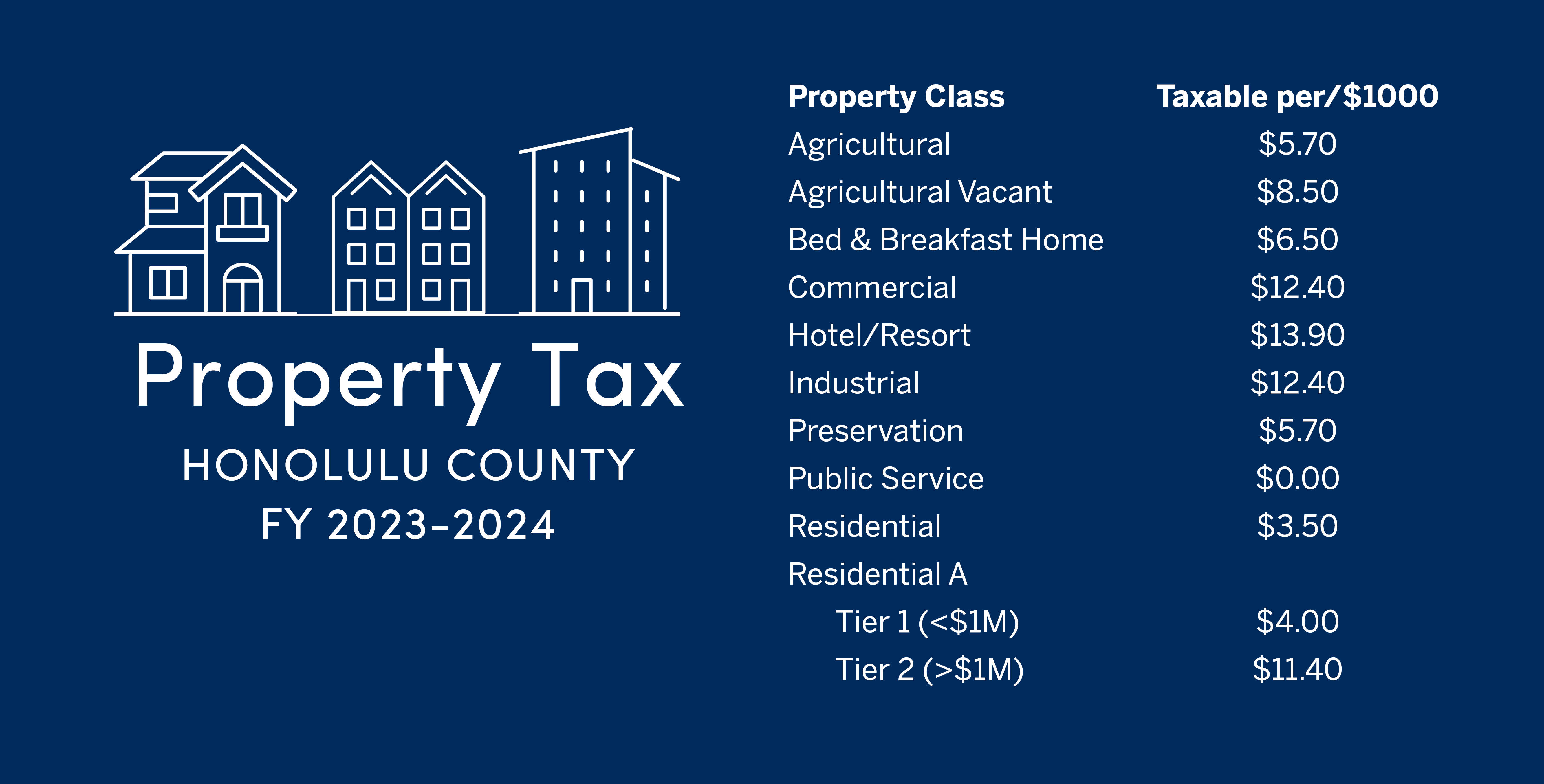

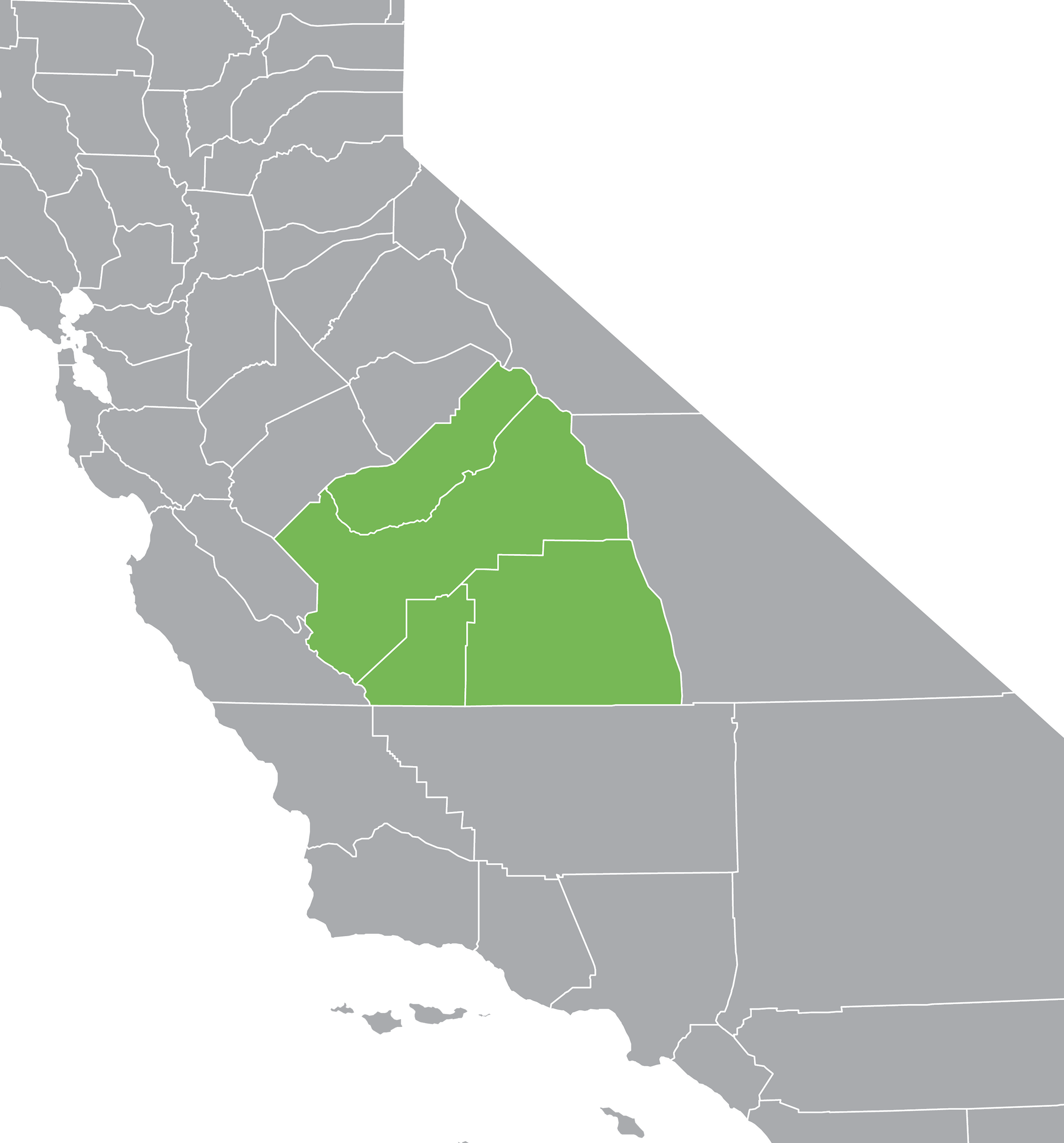

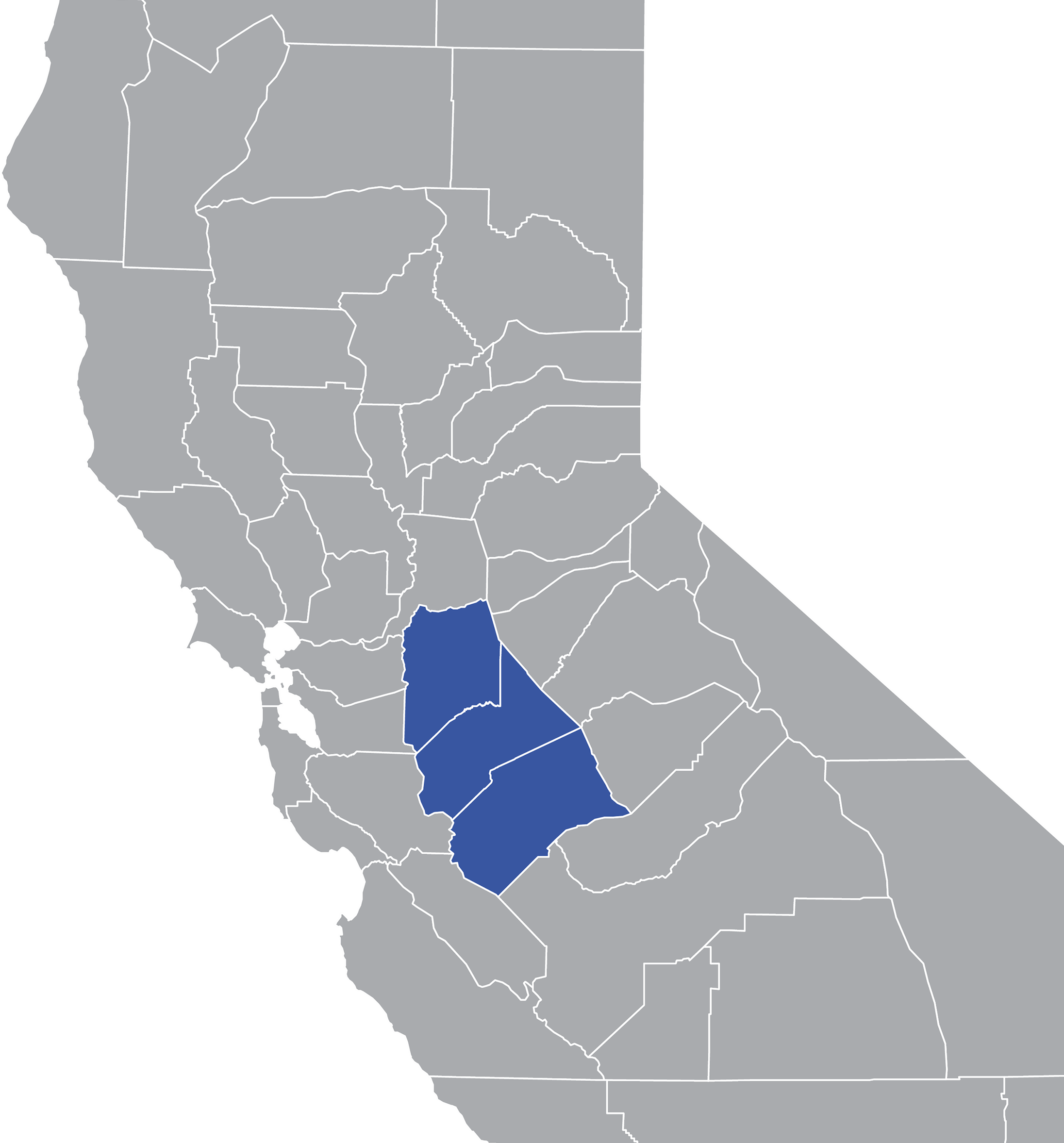

Webthe median property tax in san joaquin county, california is $2,340 per year for a home worth the median value of $318,600. San joaquin county collects, on average, 0. 73% of. Our mission is to ensure the safekeeping of public funds while. Webexplore the charts below for quick facts on san joaquin county effective tax rates, median real estate taxes paid, home values, income levels and homeownership rates, and. Weblearn all about san joaquin real estate tax. Whether you are already a resident or just considering moving to san joaquin to live or invest in real estate, estimate local. Webthe median property tax (also known as real estate tax) in san joaquin county is $2,340. 00 per year, based on a median home value of $318,600. 00 and a median effective. Weboverseeing the property tax billing and collection process for secured and unsecured property taxes levied by california state law, we assist the public in understanding their. Quickly find treasurer & tax collector phone number, directions & services (stockton, ca).

Related Posts

Recent Post

- Cbs Picks Against The Spread

- Gabriel Kuhn Case

- West Virginia Fish Stocking

- Taco Bell Jobs Part Time

- Fantasy Baseball Pitcher Rankings Today

- Used 2018 Chevy Silverado For Sale

- Busted Newspaper Bell County Tx

- Nick Bare Workout Routine

- Cash App Balance Screenshot

- Femdom Deviantart

- Dewayne Coker Hillsborough

- Accuweather Com Local Forecast

- Duke University Crna Program

- Greece Police Blotter

- Mlb Top Prospects

Trending Keywords

Recent Search

- Blount County Obituaries

- Fios Equipment Return

- Good Day Farm Dispensary Imperial Mo

- Morning Call Obituaries Northampton County

- Local Patch News

- Silive News

- Is Sheila Dead On Bold And Beautiful

- Spiritualist Shops Near Me

- Busted Mugshots Columbus Ohio 2023

- Maeder Quint Tiberi Funeral Home Obituaries

- Underground Weather Mesa Az

- Safeway Home Delivery Near Me

- Zillow Destin Fl

- Michigan Lottery Mobile App

- Hunter Polgar Obituary

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)