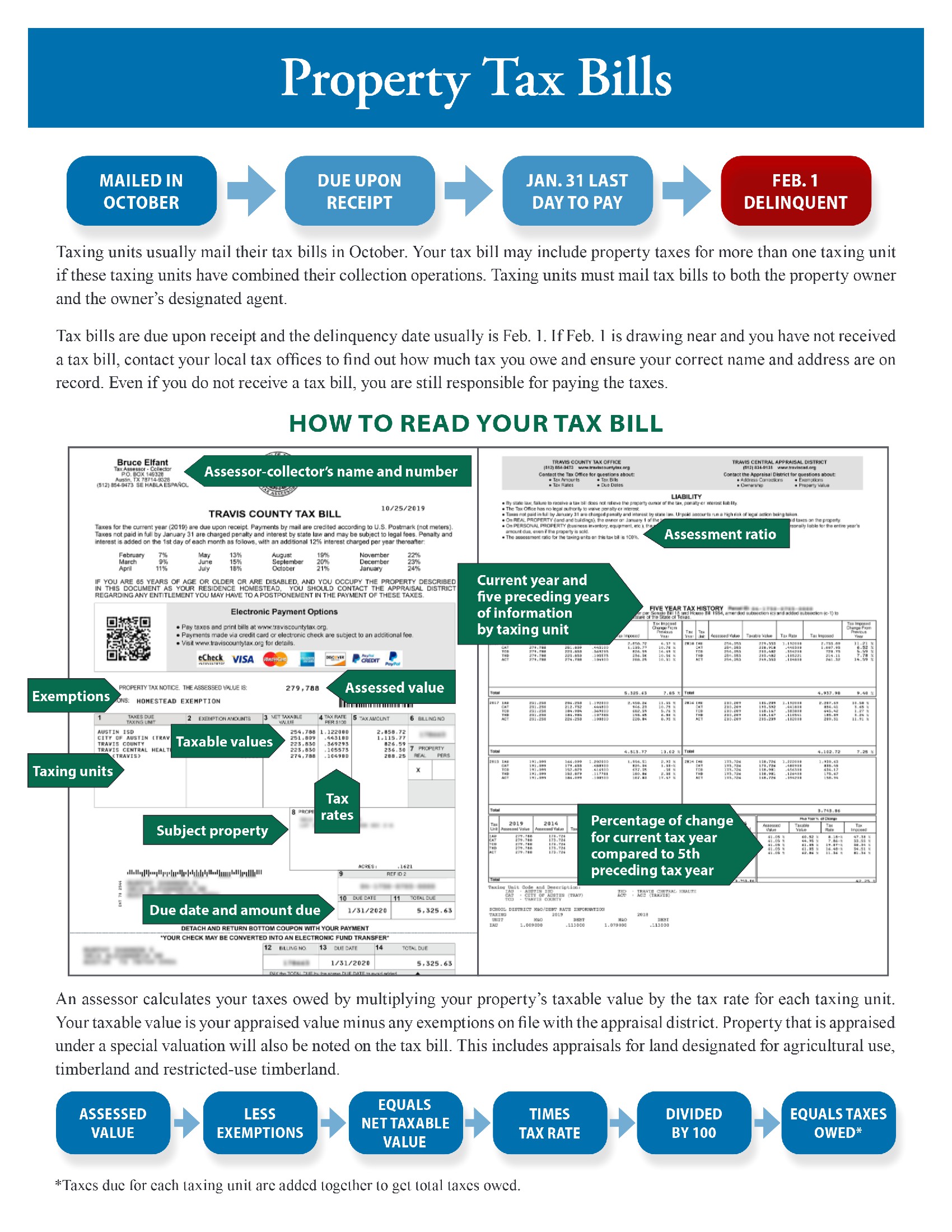

If the tax rate in your community has been established at 1. 20% (1% base rate plus. 20% for prior indebtedness) the property tax would be calculated as. We offer free tax return preparation for qualified individuals and families with an annual household income of $75,000 or less or. Websearch secured, supplemental and prior year delinquent property taxes : Secured tax bills are payable online from 10/2/2024 to 6/30/2025. Most supplemental tax bills are. Webproperty taxes in fremont average $8,050 annually, with a median assessed value of $650,100. The municipal performance dashboard includes financial and operating measures important to the government and its citizens. Webthe real property section is responsible for the appraisal and acquisition of property interests needed for public projects. The section is also responsible for the management. Webproperty construction or change in property ownership. Pay, look up or download your supplemental bill.

Recent Post

- Pyrocynical Gamersupps Cup

- Zillow Barstow

- Stellaris Daemonic Incursion

- Winston Salem Police Reports

- Wbal Weather

- People Search Uvapodcast Html

- Aquarius Lucky No

- Alexandria Town Talk Obituaries

- Zillow East Norwich Ny

- Police Scanners For Sale

- Citi Bestbuy Credit Card

- List Of Disney Films Wiki

- 24 Hour Fitness Membership Cost

- Greenhouse Menards

- Companion Caregiver Positions

Trending Keywords

Recent Search

- Staunton News Leader Obituaries

- Qvc Todays Special Valuefav Page Html

- Joyology Of Mt Clemens Mount Clemens Photos

- Cedar Memorial Obituaries

- Sales Tax Issaquah Wa

- Onondaga County Real Property Imagemate

- Edgar Cayce Map Of Us

- Obituaries Columbia Missouri

- Sams Syf Synchrony Bank

- Denver Cars By Owner

- Abandoned Places In Mn For Sale

- Nj Transit Ne Corridor Timetable

- Sj Courier Post Obituaries

- Madison County Buy Sell And Trade

- Madison County Buy Sell Trade

.jpg)