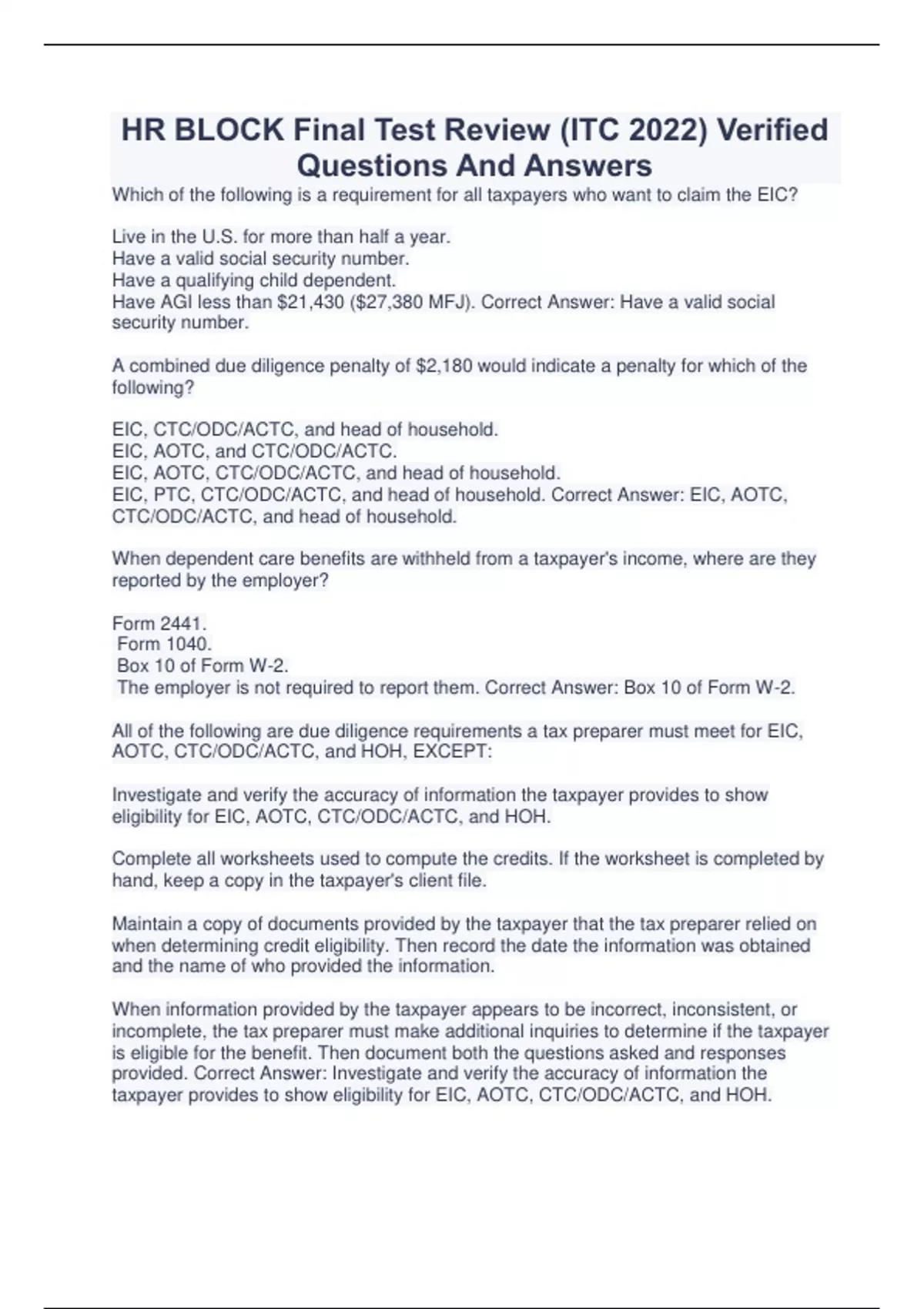

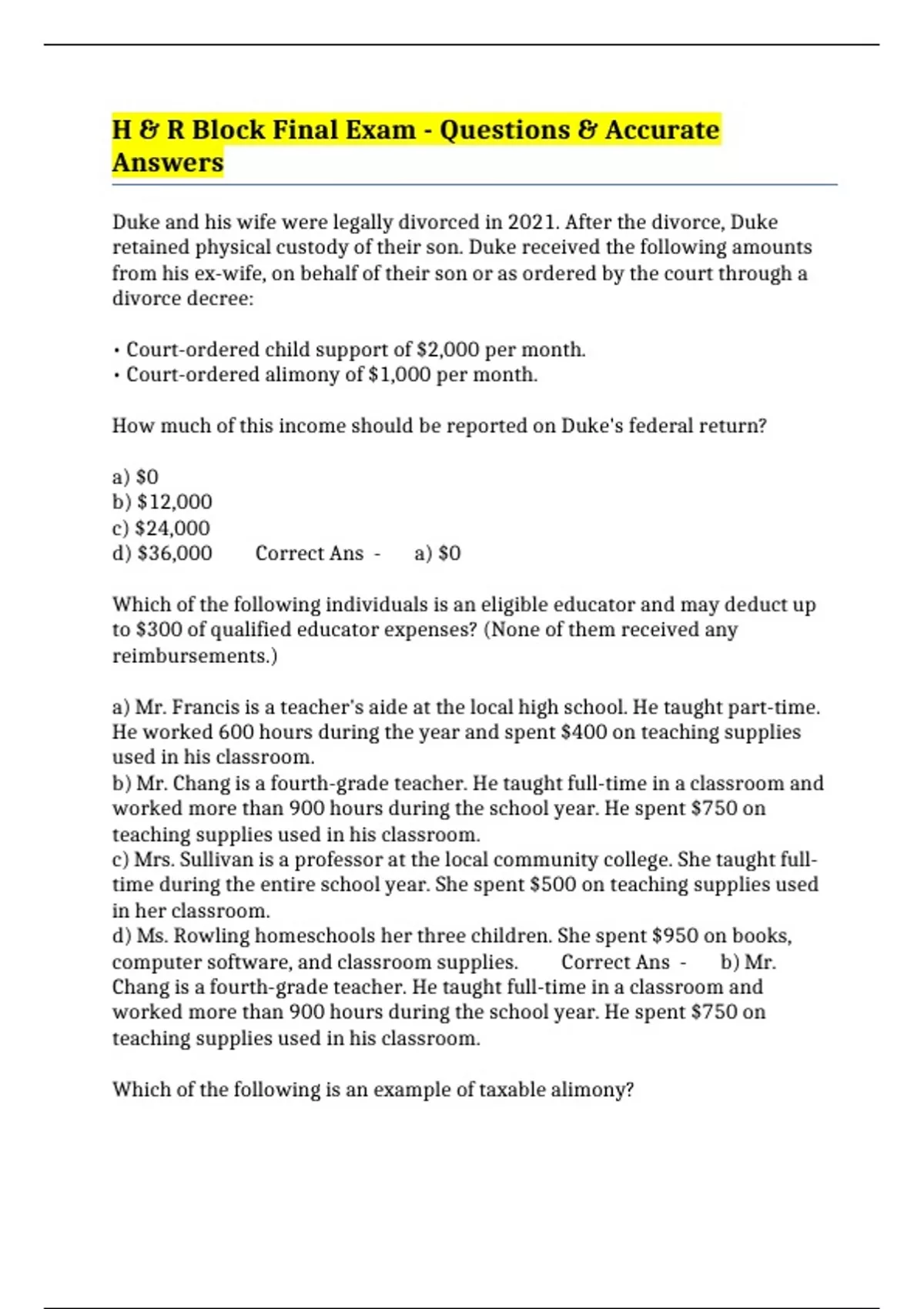

Webhe borrowed $900,000 and purchased a new main home in march of 2020. Soledad will be itemizing his deductions. On what portion of the acquisition debt will interest be deductible on soledad's tax return for 2022? Complete questions & answers (grad... Webwith these case studies, you will be able to identify the where, how, what, and how of the h&r block final exam case study answer. Some of the main characteristics of descriptive case studies include: Web3 days ago · study with quizlet and memorize flashcards containing terms like which of the following is a requirement for all taxpayers who want to claim the eic? Live in the u. s. For more than half a year. Have a valid social security number.

Related Posts

Recent Post

- Home Depot Rental Truck

- 30 Cashapp Balance

- Arrest Records St Lucie County Florida

- Worship Female Feet

- Molly Qerim Relationships

- Kingsport Times Newspaper Obituaries

- Lexington Herald Leader Obituaries

- Faith Tattoo Arm

- Big Bear Real Estate Zillow

- Horizon Nj Health Provider Lookup

- Holly Brantley

- The Desert Sun Obituary

- Hilarious Twitter Posts

- Ombre Nail Designs

- Boxwell Brothers Funeral Directors Obituaries

Trending Keywords

Recent Search

- Wegmans Burlington Bakery

- Dsp Owner

- General Hospital Update Today

- Detail Shops For Rent

- Plumbers Apprentice Jobs

- Nissan Commercial Actor

- Herald Online Obituaries Rock Hill

- Panera Bread Jobs Pay

- Ohio State University Mychart

- Giant Eagle Grocery Ad

- Cse 412 Uw

- Amazon Dsp Driver Hiring Process

- Mating Horses Gif

- Vanderburgh County Inmate Mugshots

- Walk In Showers At Menards