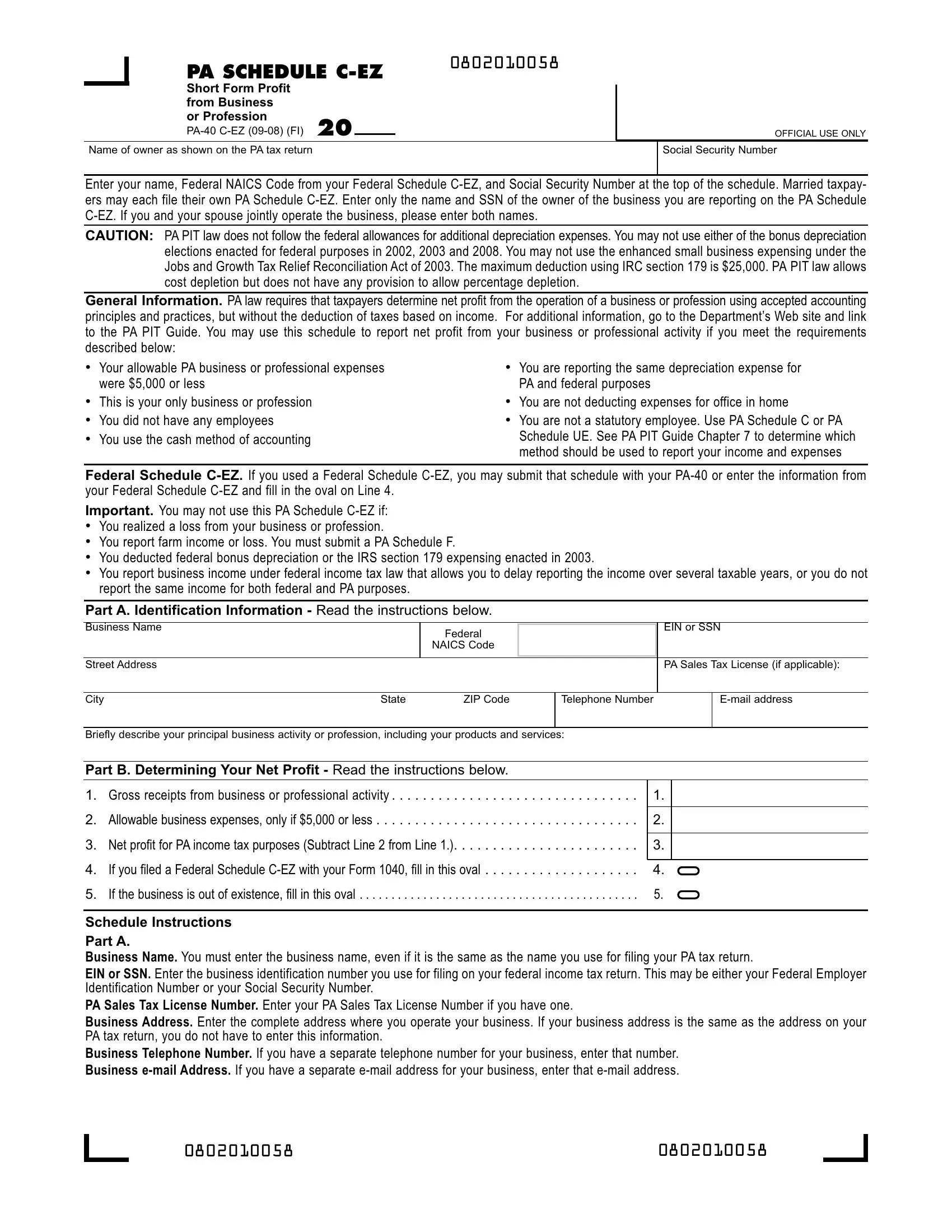

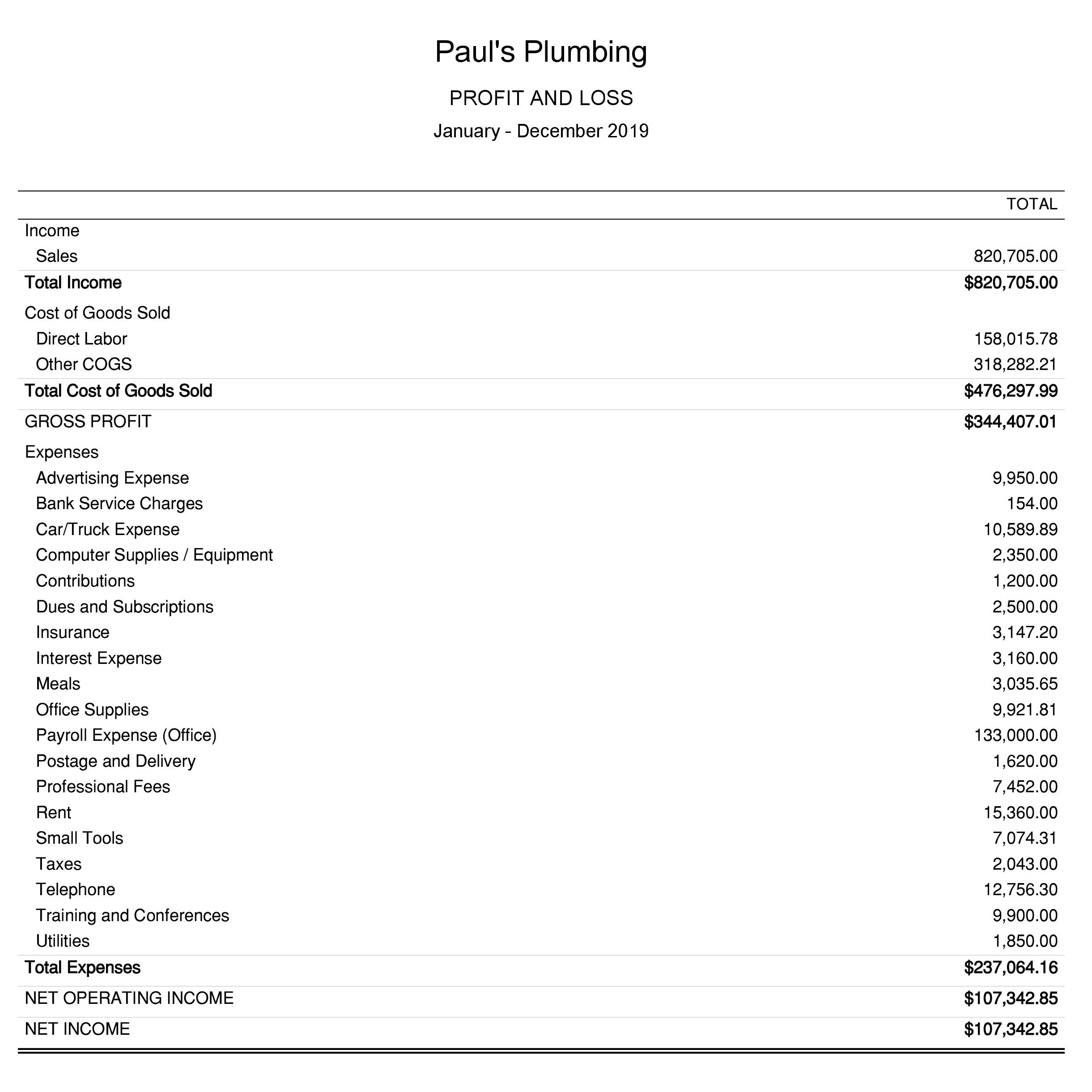

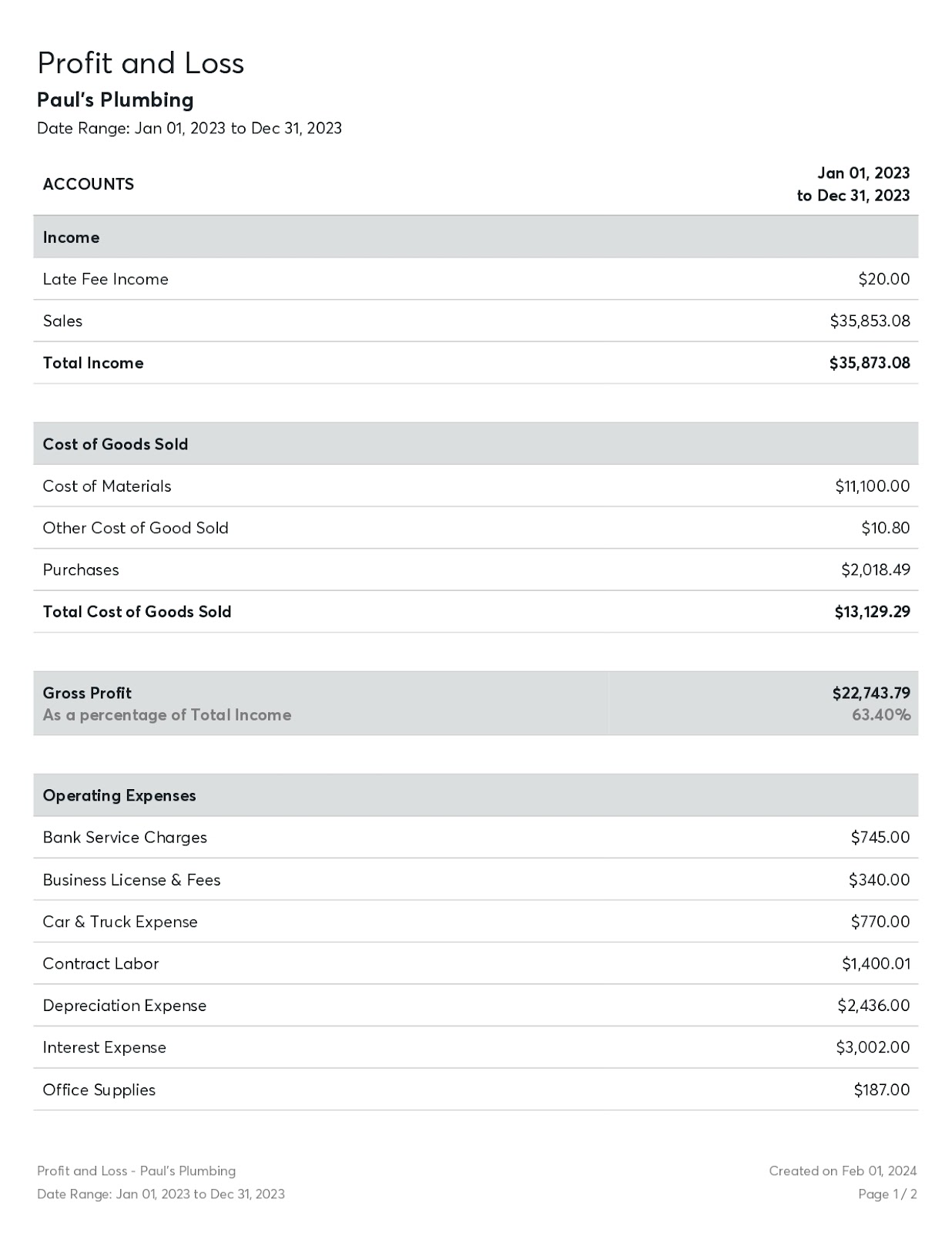

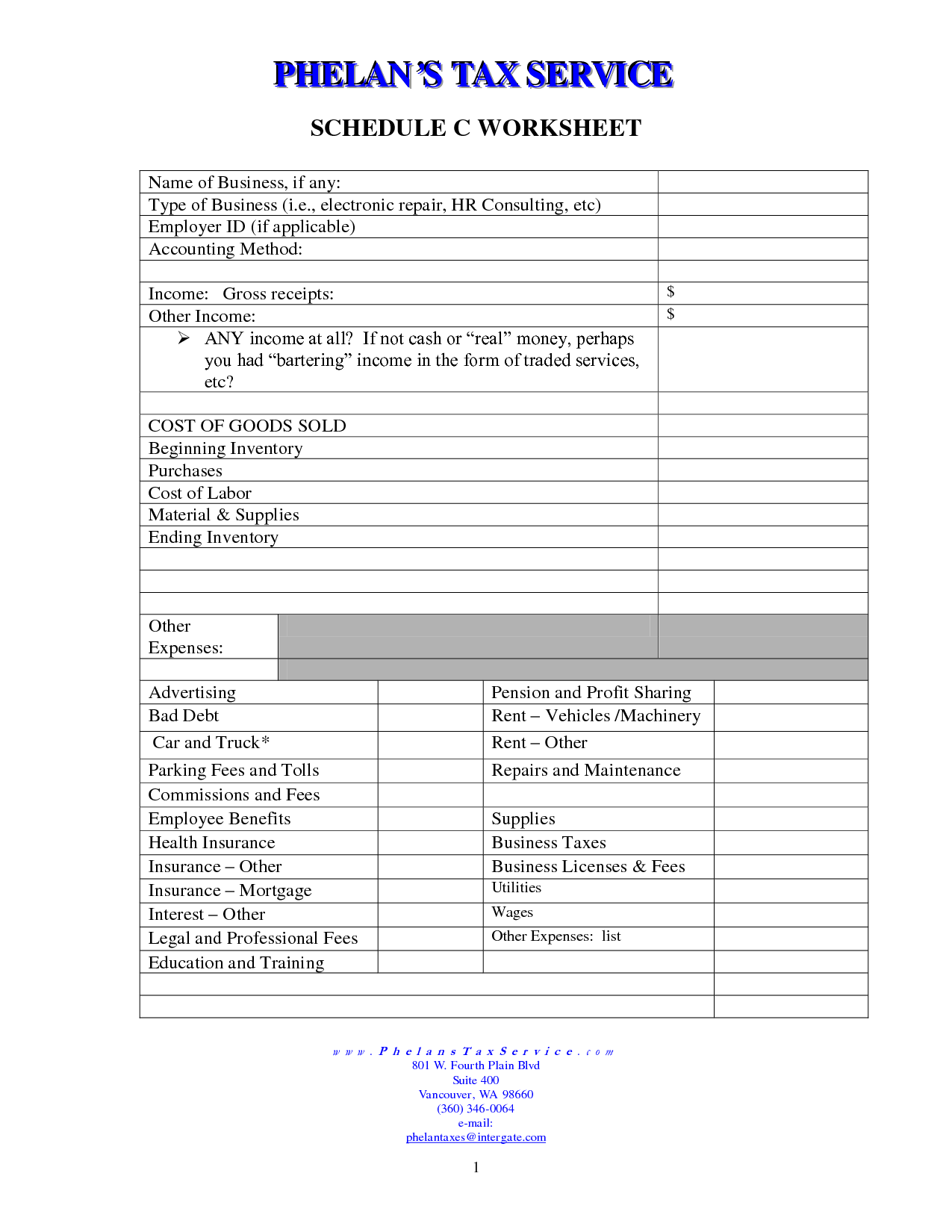

Websep 19, 2022 · schedule c is the linchpin of your independent contractor taxes. It's the form that lets you claim business expenses regardless of whether you itemize your tax. Webfilling out schedule c for your doordash business is a relatively straightforward process. Here are the key sections and questions you need to pay attention to: Webfilling out a schedule c is one of the most effective ways for doordash contractors to pay only what they owe in taxes. Documenting their business income and expenses ensures. If you want to deduct expenses related to your income then you will need. Webuse schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your.

Related Posts

Recent Post

- Clarence Aikens

- Death Notices Jacksonville Fl

- Five Below Store Com

- Postal Service Job Openings

- Missouri Highway Accident Reports

- Zillow Suamico Wi

- Papa Johns Employment

- Savage Comebacks In An Argument

- In Town Moving Truck Rental

- Pet Supplies Plus Vet Clinic Hours

- Hobby Lobby Model Kits

- Crime Watch Minneapolis Twitter

- Los Gatos Pediatric Urgent Care

- Kristen Stewart Imdb

- Costco Jobs Miami Fl

Trending Keywords

Recent Search

- Hy Vee Gas Perks

- Kezi Breaking News Today

- Wtap Obituaries

- Scorpio Horoscope Tomorrow

- Ferry Schedule Hull To Boston

- Nola Obituaries

- Port Authority Schedules

- Fatal Route 15 Nj Accident Today

- Green Seal 2 Dollar Bill Value

- Cobb County Mugshotscoming Soon Html

- Cross Guitar Tattoos

- Spirit Halloween Store Locator

- Brownsville Pd

- Imdb Martin Scorsese

- Roanoke City Warrant List

/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)